We are all guilty of it, taking things for granted because of the amazing lives we have and forgetting that millions of people in the world have much less than we do. About a year ago, my Mum returned from a one year sailing expedition to the Bahamas. They spent and entire year living on the boat sailing to the Bahamas from Ontario and back. One of the things I remember Mum saying once she returned to work, despite missing her sailing life, was “But CASIE, we have FRESH RUNNING WATER!“.

I always remind myself of that moment when I’m about to complain that my XBOX isn’t connecting to the TV, or my wifi going down, or a chipped nail, or my iPhone app crashing, or when they don’t have my fav soup at the coffee shop that day. These aren’t REAL problems!

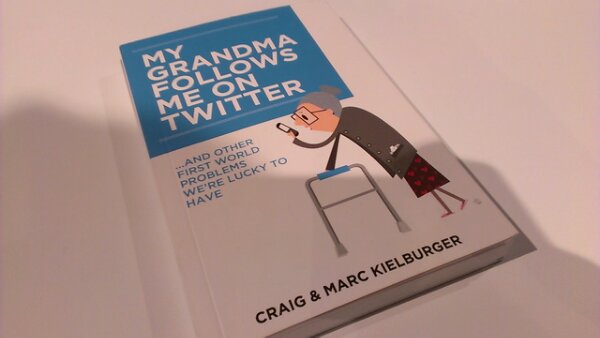

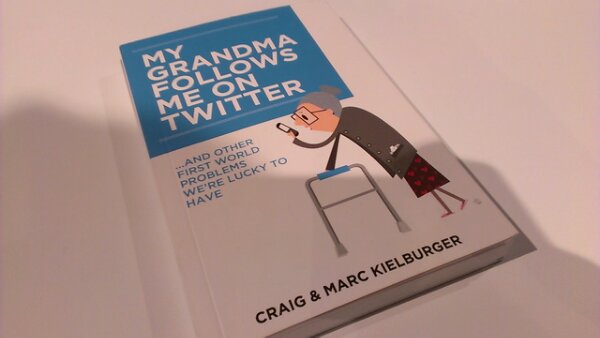

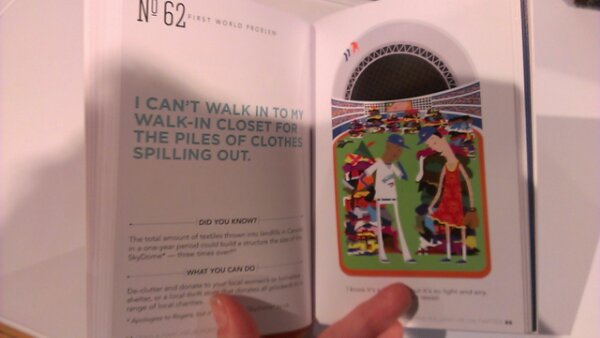

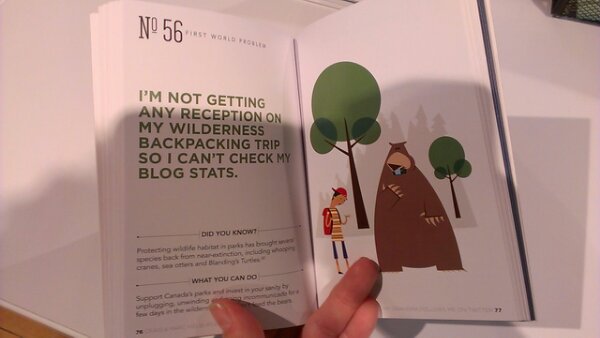

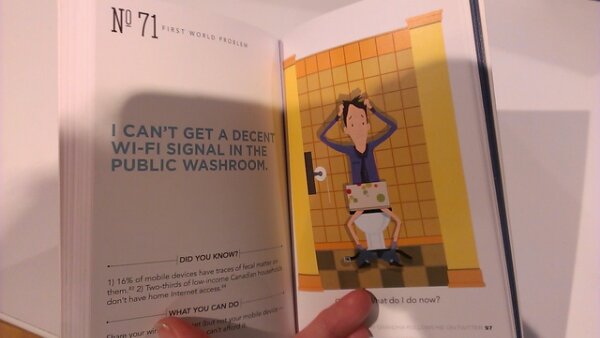

My friends at Me to We are all about living the change and making the world a better place. Craig Kielburger and his brother Marc has written a book called My Grandma Follows Me on Twitter: And Other First World Problems We’re Lucky to Have. Below are some of excerpts from the book:

Me to We have an awesome collection of gifts for the holidays. Check out the Artisans collection for jewellery made by women in Africa. There’s a TON of stocking stuffers with IMPACT. Don’t just give meaningless gifts this season, give gifts that help spread positive messages.

For You from Me to We

I have a few books that I would love to put a note in and send to you for the holidays. Leave a comment with your worst FirstWorldProblems or Tweet me. I’ll pick winners by the end of the week so I can send them off to you in the mail.

♥ CASIE

you don’t have Twitter, leave a comment on this post below and I’ll count you in.

you don’t have Twitter, leave a comment on this post below and I’ll count you in.