Return on Enjoyment: Finding That Work-Life Balance

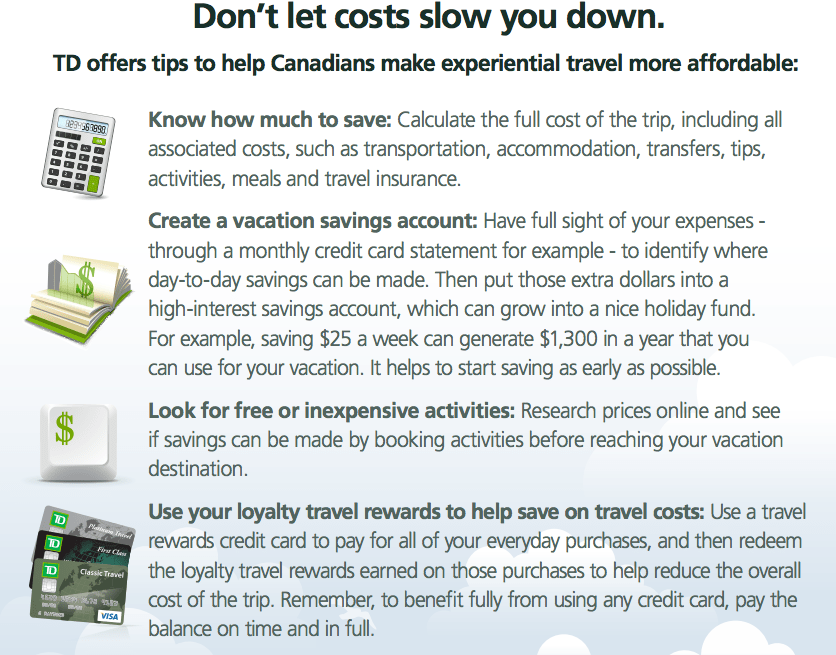

I find taking vacation or ‘staycations’ essential to my sanity. If you’re following my Twitter or Snapchat you’ll know that I’m always on the go doing something, events, speaking, dinner, travel. I love it, but tbh it’s pretty exhausting. Putting heaps of energy out (friends, work, or social) can take a lot out of you. In a recent TD survey, they found that us millennials have a hard time finding balance between financial and work commitments, and taking time to relax is a challenge. I can totally relate to this. TD found that 46% of millennials don’t take their allotted vacation days, mostly due to heavy workload (31%) and lack of travel funds (29%). Back when I was working in an agency, I hardly ever took vacation, felt pressure to work late, and when I did take vacation, found myself constantly checking my phone and responding to emails. I know I’m not alone here! The survey found, 90% of Canadian millennials agree that vacation time, even mini-vacations or “staycations”, are essential to keeping them happy. Taking time to recharge doesn’t have to be expensive, I find a good binge weekend with some cooking, takeout, and a nap (or two!) boosts me up. Having a financial plan and a budget will help you get that ROE – Return on Enjoyment. ? This weekend we opened the cottage, going there, even for a 24 hour getaway gives me leaps and bounds of energy. Don’t have a cottage? Make friends with someone who does (heh heh) or check out options like Airbnb or Glamping Hub for affordable getaways. Millennials like us can save for activities by creating a financial plan to account for funding life’s pleasures (or unexpected moments). We could all use a little more vitamin SEA, amiright? ? Other activities with…

View Post